Local Market Update – August 2020

While the pace of daily life may seem slow right now, the

local real estate market has had an unusually busy summer. The number of

new listings in July was up, sales increased, and home prices followed

suit.

• While overall inventory is at historic lows, more sellers put their homes on

the market. New listings of single-family homes in King County jumped more than

25% from a year ago. Snohomish County saw a 7% increase in new listings.

• Pent-up buyer demand fueled sales activity in July. The number of pending

sales was up 17% over a year ago in King County, and up 13% in Snohomish

County.

• With buyers snapping up new listings as soon as they hit the market, total

available inventory dropped to a 10-year low for the month.

• The lack of inventory is benefiting sellers, and multiple offers are now common

at every price point. As a result, single-family home prices rose 7% in King

County and 15% in Snohomish County.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

The Gardner Report: Q2 2020 Western Washington

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

REGIONAL ECONOMIC OVERVIEW

It appears as if the massive COVID-19 induced contraction in employment that Washington State — along with the rest of the nation — experienced this spring is behind us (at least for now). Statewide employment started to drop in March, but April was the real shock: total employment dropped almost 460,000 between March and April, a decline of 13.1%. However, this turned around remarkably quickly, with a solid increase of 52,500 jobs in May. Worthy of note is that, in May alone, Western Washington recovered 43,500 of the 320,000 jobs that were lost in the region the prior month. Although it is certainly too early to categorically state that we are out of the woods, the direction is positive and, assuming we respect the state’s mandates regarding social distancing and mask wearing, I remain hopeful that Washington will not have to re-enter any form of lockdown.

HOME SALES

- There were 17,465 home sales during the second quarter of 2020, representing a drop of 22.2% from the same period in 2019, but 30.6% higher than in the first quarter of this year.

- The number of homes for sale was 37% lower than a year ago, but was up 32% compared to the first quarter of the year.

- Given COVID-19’s impacts, it’s not surprising that sales declined across the board. The greatest drops were in Whatcom and King counties. The smallest declines were in Grays Harbor and Cowlitz counties.

- Pending sales — a good gauge of future closings — rose 35.7% compared to the first quarter of the year, suggesting that third quarter closings will grow as well.

HOME PRICES

- Home-price growth in Western Washington rose by a relatively modest 3.5% compared to a year ago. The average sale price in the second quarter was $559,194.

- Compared to the same period a year ago, price growth was strongest in Grays Harbor County, where home prices were up 14.3%. Clallam County also saw a double-digit price increase.

- It was interesting to note that prices were up a significant 6.6% compared to the first quarter. This suggests that any concern regarding negative impacts to home values as a function of COVID-19 may be overblown.

- I will be watching for significant price growth in less urbanized areas going forward. If there is, it may be an indication that COVID-19 is affecting where buyers are choosing to live.

DAYS ON MARKET

- The average number of days it took to sell a home in the second quarter of this year matched the second quarter of 2019.

- Across the entire region, it took an average of 40 days to sell a home in the second quarter. I would also note that it took an average of 14 fewer days to sell a home than in the first quarter of this year.

- Thurston, King, Pierce, and Snohomish counties were the tightest markets in Western Washington, with homes taking an average of only 17 days to sell. All but two counties, Grays Harbor and Cowlitz, saw the length of time it took to sell a home drop compared to the same period a year ago.

- Market time remains well below the long-term average across the region. This is due to significant increases in demand along with the remarkably low level of inventory available.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

What a difference a quarter makes! Given that demand has reappeared remarkably quickly and interest rates remain historically low, it certainly remains a seller’s market and I don’t expect this to change in the foreseeable future.

The overall housing market has exhibited remarkable resilience and housing demand has rebounded faster than most would have expected. I anticipate demand to remain robust, but this will cause affordability issues to remain as long as the new construction housing market remains muted.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

This Home Office Will Make Work a Dream

As the pandemic drags on, many of us are continuing to struggle while working from home in less than ideal conditions. Whether it’s the lack of an actual desk, or the distractions of kids, pets or even the dishes you meant to do last night, it can be difficult to stay focused during your working hours.

Luckily, office space designer Autonomous has created the home office of your dreams — and they’ll deliver it right to your door.

Comfortingly titled the “Zen Work Pod,” this portable office space promises to create a calm, organized workspace free from distractions. Complete with a SmartDesk 2 – Home Office, a Kinn Chair and plenty of shelves, the Zen Work Pod is your office away from the office.

Floor-to-ceiling tempered glass walls, a high sloped ceiling and pre-installed lighting fixtures ensure that you’ll have plenty of breathing room and space for your creativity to flow. But the Zen Work Pod is more than just a temporary solution. Built with sustainable wood, strong aluminum and tempered glass, the pod can handle almost any weather, no matter where you choose to place it.

Not only will Autonomous deliver just about anywhere in the U.S., they’ll also install the Zen Work Pod for you at no extra charge. The pod’s lightweight and innovative design requires no in-ground fixtures, meaning it can be installed on just about any flat surface — including concrete, grass, gravel or soil.

This minimalistic paradise can also function as more than a simple office space. The surprisingly versatile design makes the pod perfect for everything from a personal yoga studio or music room to a backyard bar or reading room.

Normally retailing around $14,900, early-bird subscribers can purchase the pod for as little as $5,400 — practically a steal.

So if you’ve got the working-from-home blues and a backyard begging for a new addition, the Zen Work Pod could be your ticket to a more tranquil workspace.

Check it out for yourself here.

This post originally appeared on GettheWReport.com

A Historic Rebound for the Housing Market

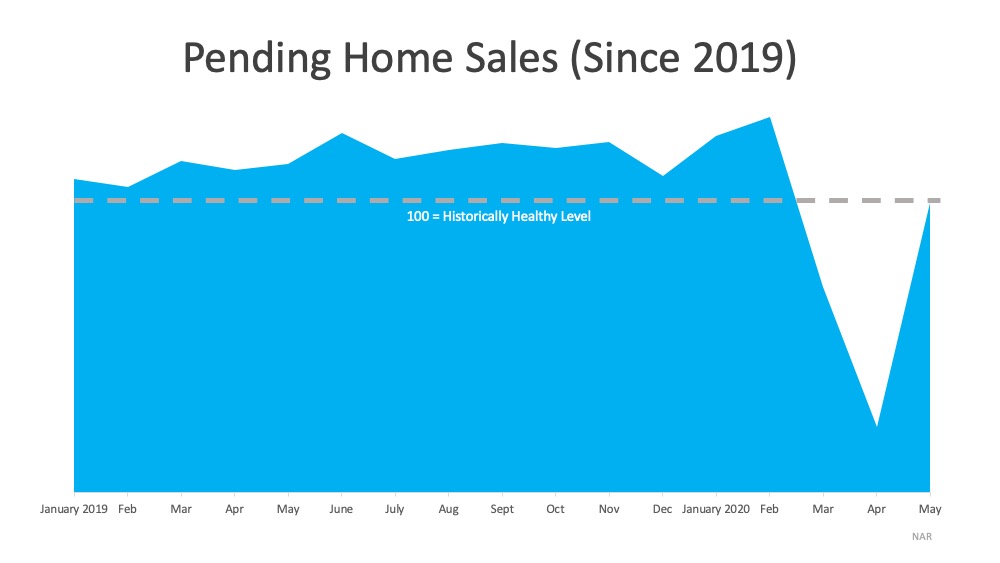

Pending Home Sales increased nationally by 44.3% in May, registering the highest month-over-month gain in the index since the National Association of Realtors (NAR) started tracking this metric in January 2001. So, what exactly are pending home sales, and why is this rebound so important?

According to NAR, the Pending Home Sales Index (PHS) is:

“A leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.”

In real estate, pending home sales is a key indicator in determining the strength of the housing market. As mentioned before, it measures how many existing homes went into contract in a specific month. When a buyer goes through the steps to purchase a home, the final one is the closing. On average, that happens about two months after the contract is signed, depending on how fast or slow the process takes in each state.

Why is this rebound important?

With the COVID-19 pandemic and a shutdown of the economy, we saw a steep two-month decline in the number of houses that went into contract. In May, however, that number increased dramatically (See graph below): This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

“This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership…This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.”

But in order to continue with this trend, we need more houses for sale on the market. Yun continues to say:

“More listings are continuously appearing as the economy reopens, helping with inventory choices…Still, more home construction is needed to counter the persistent underproduction of homes over the past decade.”

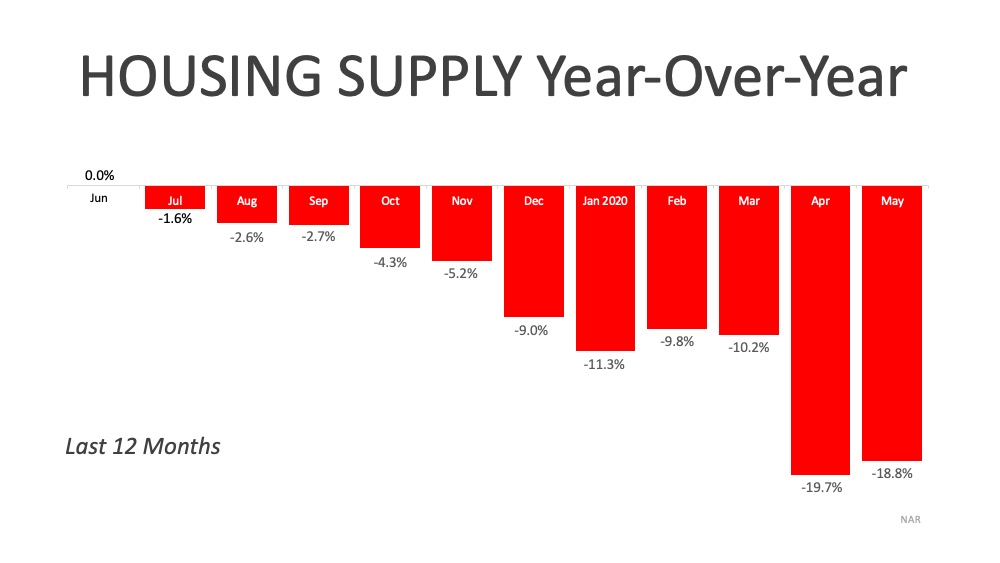

As we move through the year, we’ll see an increase in the number of houses being built. This will help combat a small portion of the inventory deficit. The lack of overall inventory, however, is still a challenge, and it is creating an opportunity for homeowners who are ready to sell. As the graph below shows, during the last 12 months, the supply of homes for sale has been decreasing year-over-year and is not keeping up with the demand from homebuyers.

Bottom Line

If you decided not to sell this spring due to the health crisis, maybe it’s time to jump back into the market while buyers are actively looking for homes. Let’s connect today to determine your best move forward.

Local Market Update – June 2020

As we move to the next phase of reopening, life feels like it’s slowly inching back towards normal. The same is true in real estate. Statistics on home sales in May provided the first true picture of the effects of COVID-19. Those reports confirmed the incredible strength and stability of the local real estate market.

- The Stay Home order, as expected, continued to impact the number of sales. However, the market is starting to move its way towards more normal activity. Pending sales, a measure of current demand, have risen every week since April.

- The slight drop in median closed sale price is a result of a proportionately larger number of lower priced homes selling than is normal. It should not be interpreted as a decrease in individual home value.

- There were significantly fewer homes for sale in May than the same time last year. With less than a month of available inventory, competition among buyers was intense. Bidding wars and all-cash offers were common.

The monthly statistics below are based on closed sales. Since closing generally takes 30 days, the statistics for May are mostly reflective of sales in April. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here. As we adapt to new phases of reopening, know that the safety of everyone remains our top priority.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Seattle Poised for Faster Recovery than Many Other Cities

It may feel like a tired refrain after nearly three months of quarantine, but it remains true: it’s still too early to truly tell the toll COVID-19 will take on our economy — both locally and nationally — until we are able to fully reopen and jumpstart area businesses.

Thanks to our diversified economy, strong tech sector and attractive, startup-friendly environment, the Seattle area is well-positioned for and capable of a nimble recovery.

Several recent studies analyzing our housing market, population density, and educational attainment (and jobs that require higher education) indicate that Seattle is primed for a recovery that may be quicker and shorter than other major metropolitan areas across the country.

ATTOM Data Solutions, a provider of real estate and property data, put together a special report comparing regions across the country and identifying the housing markets more and less vulnerable to COVID-19 impacts. Their research puts King County within the 50 least at-risk counties. Furthermore, their data shows the West Coast as a whole to be incredibly resilient, with only one West Coast county (in California) appearing in the top 50 most vulnerable markets.

Looking at population density and education, Moody’s Analytics assessed the 100 top metro areas in the country and identified the U.S. cities in the best and worst positions for post-pandemic recovery. Their research notes that the cities best prepared to bounce back have low population densities and high levels of educational attainment. Seattle ranked in the top five metros poised for a quick recovery.

While the recent economic contraction has been profound and carried many unseen ramifications, our region’s tech sector has remained strong. Dominating much of our local economy, tech’s presence here may help buffer our area’s economy from worse dips taking place elsewhere.

It is true that some sectors of our regional economy — particularly hospitality (restaurants and bars), leisure (hotels), tourism and travel — have been hit harder. Those businesses and employees feel the impacts more strongly and may experience a harder and more drawn-out recovery. The direct hits to these sectors — with shuttered businesses and job losses — will resonate through the economy at large. As noted by Windermere Chief Economist Matthew Gardner in a recent “Mondays with Matthew” post looking at how COVID-19 has affected employment, it’s likely that many workers in these sectors are renters, so their misfortunes are likely to impact the region’s rental market. As businesses are forced to close, many may struggle to find new employment until the economy is open and fully operational again.

Loss of tax revenue from the retail, hospitality and tourism sectors (especially from cruise ships, many of which will not be docking in Seattle for the foreseeable future), is already impacting state and local budgets, potentially causing painful future spending cuts over the next few years, as noted in The Seattle Times.

While our economy — city, state, and national — has shrunk dramatically in the second quarter of this year, economists still anticipate recovery beginning as soon as businesses reopen, and stay-at-home orders are lifted. Gains will advance slowly, but will continually increase through the remainder of the year. As Matthew Gardner predicts, the second half of 2020 should be significantly better than the first.

This post originally appeared on GettheWReport.com

Windermere Insights: How COVID-19 is really impacting local real estate

The challenges presented by COVID-19 have been felt locally by every home buyer, seller and real estate broker. Residential real estate, which was moving at breakneck speed through February, came to a screeching halt for two weeks in March after the initial Stay Home order was implemented.

As soon as Governor Inslee declared real estate an essential business, the engines started to rev again. Despite job losses and a nosedive in general consumer confidence and spending, home buyers started to jump back into the market. Theories abound about why this could happen in the middle of a pandemic:

- With some exceptions, our local tech sector has generally performed well during COVID-19 and its employees may feel reasonably insulated from the worst of the economic fallout. For some, their stock options may have actually increased in value during the worst of the coronavirus.

- Many buyers were already feeling the squeeze of low housing inventory and the defeat of losing out in multiple-offer situations. Some likely saw the lower competition during the shutdown as an opportunity to finally gain a foothold.

- Mortgage rates in the early stages of the shutdown dropped to historic lows, with some 30-year fixed loans carrying percentage rates in the low threes.

- Renters and homeowners with sustained income security found themselves suddenly doing everything from home – working, schooling, exercising – which may have motivated them to pursue a change in space, moving from dreamers to active buyers.

- Lots of real estate “window shoppers” suddenly had a lot more time on their hands and spent hours perusing eye-candy listings online and watching more HGTV than ever, accelerating their property lust and their entry into the buyer pool.

Some of these theories have metrics behind them and some remain just theories. Regardless of the motivation, buyers are back “out” in force, touring prospective homes online, via livestream video with a broker or pre-produced 3D tours and videos. Brokers are showing them homes in person too – while following many safety precautions. Because of this strong buyer interest, prospective sellers are hearing from their brokers that now may be a good time to list.

For weeks now, we have seen multiple offers on homes in popular neighborhoods. Brokers, for whom business was put on hold at the end of March, are as busy as at any other point this year. Though the new normal is still not completely normal, the market in many neighborhoods and price points seems to be skipping along as if it were.

To learn how various sectors of our local real estate market are performing during COVID-19, we asked Windermere experts from Seattle and the Eastside what they are seeing.

Real Estate Across Seattle

Laura Smith, co-owner and principal broker of Windermere Real Estate Co., which operates multiple real estate offices in Seattle, has been busy helping brokers ramp up quickly and navigate a hefty transaction load along with new protocols for listing and showing homes. “It’s been a total whirlwind,” she said. “The market went from zero to sixty in a heartbeat.”

Smith explained that out of nine MLS areas in the city of Seattle, seven had less housing stock (measured as months of inventory) than what was available in May 2019, and the other two areas had the same inventory levels as last year. She noted that Seattle’s pending home sales during Week 3 of May already had reached 95% of the transaction count from the same week in 2019.

“Right now buyers want in,” Smith said, “and inventory numbers favor sellers.” Prices, as a result, have “stayed strong,” according to Smith, even in the midst of a health-related shutdown.

Bouncing Back on the Eastside

According to Matt Deasy, President of Windermere Real Estate / East, Inc., the volume of business has bounced back quicker than expected and brokers are busy helping buyers and sellers while following new practices to prevent the spread of the coronavirus.

“After reentering the market, buyers are finding the competition as fierce as it was before COVID-19,” Deasy said. His analysis shows that while Eastside pending sales are still down from a year ago, by Week 2 of May they were at 73% of last year’s figure from the same week. “Each week we are seeing the market steadily catch up to last year,” Deasy observed, “and I think it will soon head north of 2019 weekly transaction yields.”

Deasy pointed out that low Eastside housing supply is a challenge for buyers rushing back in to the market. “There is so little for sale” he said, noting that of the Eastside’s eight MLS areas, all but one had extremely low levels of inventory. “In fact,” Deasy continued, “three Eastside areas have a month or less supply of homes.” As a result, he predicts that “prices in popular neighborhoods will continue to climb” for the foreseeable future.

The Luxury Market

Patrick Chinn, owner of Windermere Real Estate Midtown, regularly works with luxury brokers and their clients. He observed that the luxury market was proceeding at a seasonally appropriate pace prior to the shutdown but has appeared a little slower to come back online as restrictions on real estate lifted. “Luxury sellers are typically not in a rush,” Chinn noted, “and the safety considerations of listing a home during COVID-19 may have delayed” their entry into the market.

Due to their high net worth, luxury buyers on the other hand may have been “less adversely impacted by the very real economic impacts of the shutdown,” Chinn said. But he also observed that fluctuations in the stock market usually make for “a restless luxury market, despite greater potential access to capital.” Chinn expects the pace of new high-end transactions and inventory to remain below what it was pre-shutdown, at least until there’s a clearer economic picture in sight.

Chinn did note that if a singular property is listed during an economic downturn such as the one we now find ourselves in, there can still be great urgency by luxury buyers to purchase. He gave as an example a Medina property listed during the topsy-turvy days just before the shutdown that quickly went under contract at its asking price of $11.75 million. “Iconic homes on iconic streets will still generate lots of enthusiasm, even during a downturn,” Chinn said.

He reported that one of his brokers went full speed ahead to list a one-of-a-kind beachfront property in Magnolia. Even during the lingering impacts of COVID-19, “there’s no time like the present for listing incredible homes,” Chinn explained.

Continuing New Construction

Joe Deasy, co-owner of Windermere Real Estate / East Inc., says that the early phase of the shutdown created significant waves for residential builders. Initially both the building and listing/showing of all residential new construction projects were stopped due to the Stay Home order.

As builders start building again and brokers start showing finished units, “the early pace will naturally be a bit slower,” Deasy said. He explained this as a result of builders needing to rehire furloughed workers and buyers’ agents implementing safety measures to prevent the spread of the coronavirus.

“I expect things to accelerate pretty quickly as we move forward,” Deasy predicted. His reason? “There’s so little inventory out there, both new construction and resale,” he explained. “The product that is available looks pretty attractive right now, since it’s brand new and no one’s ever lived in it.”

Deasy remains positive about the region’s new construction market. He pointed out that leading into the Stay Home closure, Windermere’s King County new construction business was through the proverbial roof. “Even factoring in the shutdown, our year-to-date unit sales are up 41% over last year,” he noted, “and our sales volume is already at $700 million.”

Looking ahead, Deasy predicts that demand for new construction homes will remain strong and that supply will have the biggest impact on the sector’s overall market performance. “Low inventory may influence 2020 sales more than the shutdown,” he explained, “which, all things considered, was relatively brief.”

This post originally appeared on GettheWReport.com

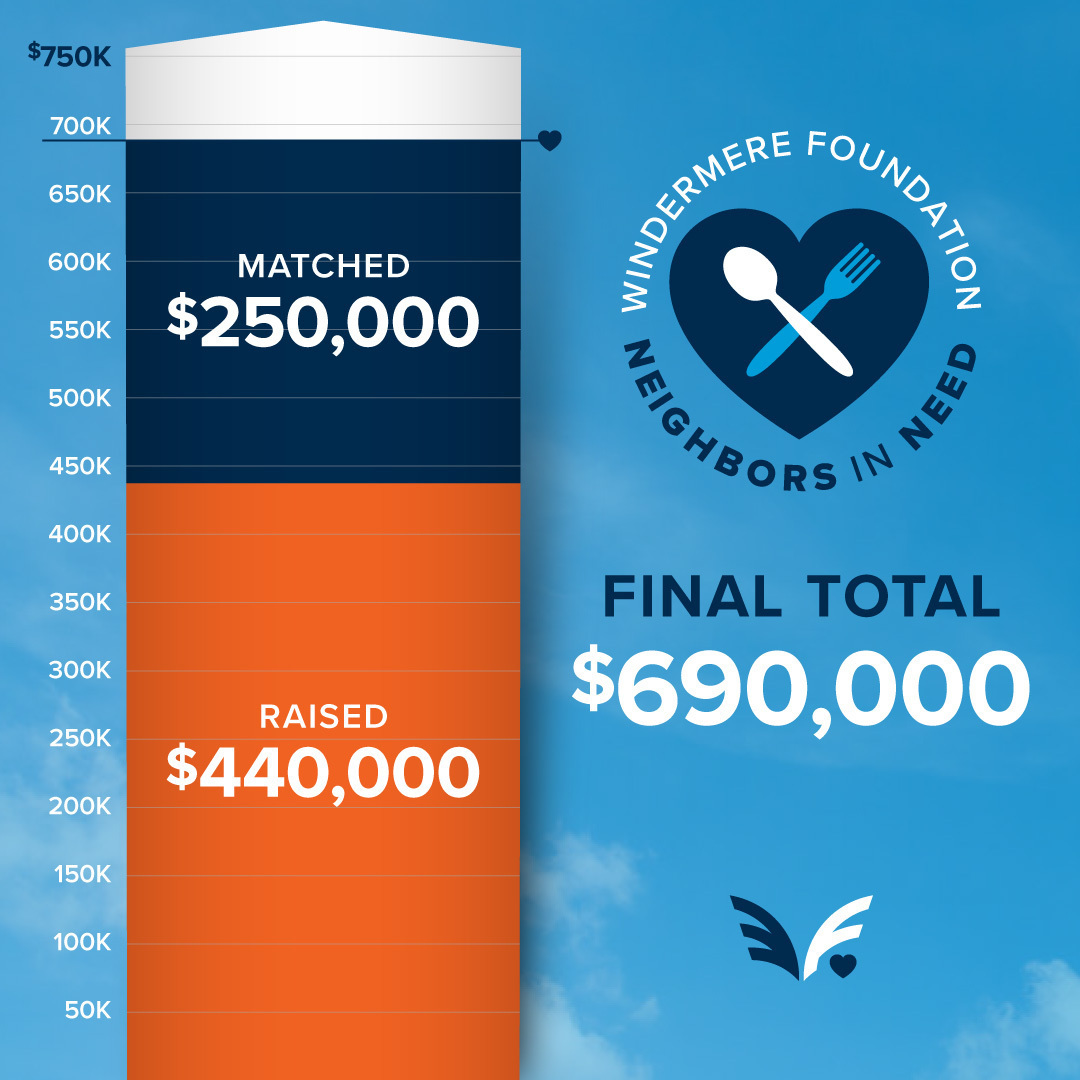

Neighbors in Need Raises $690,000 for Food Banks

The COVID-19 pandemic has affected populations across the globe, but those who struggle with poverty and count on food programs to meet their basic day-to-day needs are in an especially uncertain place. While coping with increased demand and a bottlenecked pipeline of food supply, food banks are desperate for funds to continue to serve their communities. Because of this, Windermere decided to challenge its offices to raise $250,000, every dollar of which would be matched by the Windermere Foundation and donated to food banks in the areas where Windermere operates. We titled it the “Neighbors in Need” fundraising campaign.

Neighbors in Need kicked off on April 21, with the goal of raising $250,000 by May 5. As word continued to spread, online donations and contributions from both our agents and the public began to increase. Neighbors in Need was given a boost by Seattle Seahawks starting safety Quandre Diggs in a heartfelt message encouraging support. Over the final 24 hours, leading up to the May 5 deadline, support poured in from across the Windermere family as the final figure exceeded the initial goal of $500,000, landing at a total of $690,000.

Neighbors in Need exemplifies Windermere’s deep commitment to supporting our local communities, which traces back to 1989 when the Windermere Foundation first started. Since then, we’ve proudly raised more than $41 million for low-income and homeless families throughout the Western U.S.

On behalf of the Windermere Foundation to all those who joined the effort: Thank you. We could not have made this large of an impact without your help. We are humbled to be able to do our part to help those who need it most during these uncertain times.

This post originally appeared on the Windermere.com Blog

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link